Delving into the world of car insurance quotes through mobile apps, this guide aims to provide insights on navigating the process seamlessly.

Exploring the intricacies of comparing quotes, understanding details, and ultimately selecting the best option awaits in the following sections.

Researching Car Insurance Apps

When it comes to finding the right car insurance app, there are a few key factors to consider. It's important to identify popular apps that offer features tailored to your needs and preferences. User reviews and ratings can also provide valuable insight into the overall user experience.

Let's dive into the details.

Popular Car Insurance Apps

- GEICO Mobile

- Progressive

- Allstate Mobile

- State Farm

Key Features to Look For

- Easy quote comparison tools

- Secure payment options

- 24/7 customer support

- Claims filing and tracking

User Reviews and Ratings

- GEICO Mobile: 4.8/5 stars - praised for user-friendly interface

- Progressive: 4.6/5 stars - known for competitive rates

- Allstate Mobile: 4.5/5 stars - appreciated for personalized recommendations

- State Farm: 4.3/5 stars - highlighted for responsive customer service

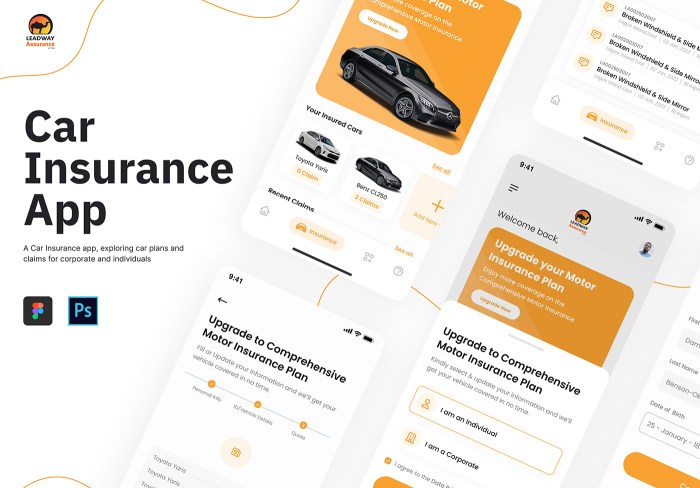

Using Mobile Apps to Obtain Quotes

When using a car insurance app to obtain quotes, you will typically start by entering your personal information and details about your vehicle. This process allows the app to generate accurate insurance quotes based on the data provided.

Entering Your Information

Once you have downloaded the car insurance app, you will be prompted to enter details such as your name, address, age, driving history, and vehicle information. It is essential to ensure that all the information you provide is accurate and up-to-date to receive the most precise insurance quotes.

Ensuring Accuracy of Information

- Double-check all the details you input to avoid any errors that could impact the accuracy of your insurance quotes.

- Provide correct information about your vehicle's make, model, year, and any modifications to get the most relevant quotes.

- Update your driving record and any recent accidents or violations to receive accurate quotes based on your current situation.

Calculating Insurance Quotes

Car insurance apps use algorithms and data analytics to calculate insurance quotes based on the information provided by users. These apps consider factors such as your driving history, location, vehicle type, and coverage preferences to generate personalized insurance quotes.

Understanding Quote Details

When obtaining car insurance quotes through mobile apps, it is crucial to understand the various components that make up a typical quote. This knowledge will help you make informed decisions when comparing different options.

Components of a Typical Car Insurance Quote

- The premium: This is the amount you will pay for the insurance policy. It is typically broken down into monthly or annual payments.

- Coverage levels: These indicate the extent of protection provided by the insurance policy. Higher coverage levels usually result in higher premiums.

- Deductibles: This is the amount you must pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your premium, but it also means you'll have to pay more in the event of a claim.

- Additional coverage options: Some quotes may include additional coverage options such as roadside assistance or rental car reimbursement.

Impact of Coverage Levels and Deductibles on Quotes

- Increasing coverage levels: Opting for higher coverage levels, such as comprehensive or collision coverage, will result in a higher premium.

- Choosing deductibles: Selecting a higher deductible will lower your premium, but you will have to pay more out of pocket in case of a claim. On the other hand, a lower deductible means a higher premium but less out-of-pocket expenses.

Additional Factors Affecting Insurance Premiums

- Driving record: Your driving history, including accidents and traffic violations, can impact your insurance premium.

- Vehicle type: The make and model of your car, as well as its age and safety features, can affect the cost of insurance.

- Location: Where you live and park your car can also influence your insurance premium, as some areas may have higher rates of accidents or theft.

- Credit score: In some cases, your credit score may be used to determine your insurance premium, as studies have shown a correlation between credit history and insurance claims.

Comparing and Selecting Quotes

When it comes to shopping for car insurance, comparing quotes from different insurance apps is crucial in finding the best coverage for your needs. Here's how you can effectively compare and select quotes:

Importance of Comparing Coverage Options

It's essential to look beyond just the prices when comparing quotes. Consider the coverage options offered by each insurance provider to ensure that you are getting the protection you need. Some key factors to consider include:

- Liability coverage limits

- Collision and comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection

Tips on Evaluating Reliability and Reputation

Aside from comparing coverage options, it's important to evaluate the reliability and reputation of insurance providers before making a decision. Here are some tips to help you assess the credibility of an insurance company:

- Check customer reviews and ratings online

- Verify the financial strength rating of the insurer

- Research the company's claims process and customer service reputation

- Look for any complaints or disciplinary actions against the insurer

Utilizing Additional Features

When using car insurance apps, it's essential to explore the additional tools and resources they offer to maximize your benefits and savings. These features can help you make informed decisions and manage your policies more effectively.

Discounts and Rewards for Safe Driving

- Some car insurance apps provide discounts or rewards for practicing safe driving habits. These can include incentives for not speeding, avoiding sudden stops, or driving during safer hours.

- By utilizing these features, you can potentially lower your premiums and enjoy perks for being a responsible driver.

- Take advantage of any safe driving programs offered by the app to earn rewards and maintain a good driving record.

Managing Insurance Policies

- Many car insurance apps allow you to manage your insurance policies conveniently from your mobile device.

- You can easily view policy details, make payments, file claims, and access important documents all in one place.

- Take advantage of the app's features to stay organized and up-to-date with your coverage, ensuring you are always protected.

Final Summary

Wrapping up the discussion on shopping for car insurance quotes using mobile apps, take away valuable tips and tricks to make informed decisions effortlessly.

Popular Questions

What key features should I look for in a car insurance app?

Some key features to consider are user-friendly interface, accurate quote generation, and a wide range of insurance providers to choose from.

How do coverage levels and deductibles impact the insurance quote?

Higher coverage levels and lower deductibles typically result in higher insurance quotes, while lower coverage levels and higher deductibles can lower the premium.

Are there any discounts or rewards offered by car insurance apps for safe driving habits?

Some apps provide discounts or rewards for safe driving habits through features like telematics that track driving behavior and offer incentives for responsible driving.