Exploring the realm of Commercial Auto Policy vs Personal Auto Insurance Explained opens up a world of contrasts and advantages. Dive into this guide filled with insights and comparisons to understand the nuances of each insurance type.

Detailing the types of vehicles covered, coverage variations, premium determinants, and legal requirements, this discussion sheds light on crucial aspects that businesses and individuals need to know.

Understanding Commercial Auto Policy

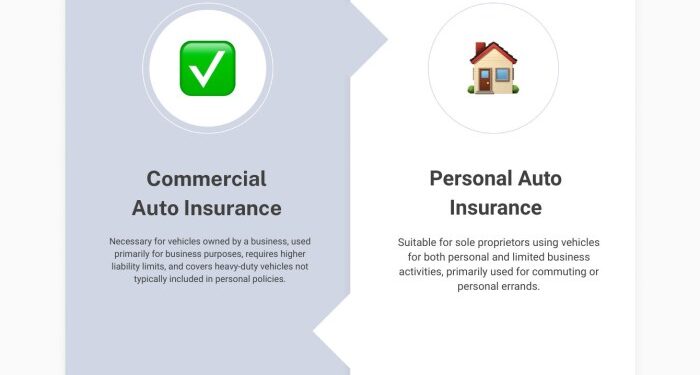

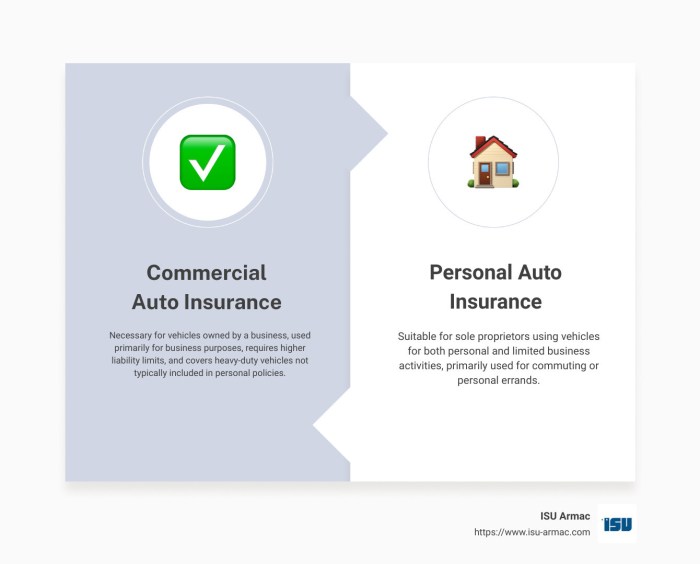

When it comes to insurance for vehicles, there are significant differences between a commercial auto policy and personal auto insurance. Understanding these variances is essential for businesses to protect their assets and liabilities effectively.Commercial auto policies are specifically designed to cover vehicles used for business purposes.

This type of insurance provides coverage for vehicles that are owned or leased by a business and used by employees for work-related activities. On the other hand, personal auto insurance is intended for vehicles used for personal transportation and does not typically cover vehicles used for business purposes.

Types of Vehicles Covered Under a Commercial Auto Policy

Commercial auto policies typically cover a wide range of vehicles, including company cars, delivery vans, trucks, and other vehicles used for business operations. These policies can also extend coverage to trailers, buses, and specialized vehicles that are essential for carrying out specific business activities.

It's important for businesses to accurately assess their vehicle usage and select a policy that provides adequate coverage for their fleet.

Main Benefits of Opting for a Commercial Auto Policy for Business Vehicles

- Liability Coverage: Commercial auto policies offer higher liability limits compared to personal auto insurance, providing greater protection in the event of accidents or damages.

- Comprehensive Coverage: Business vehicles are exposed to various risks on the road, and commercial auto policies typically include comprehensive coverage for damages not caused by collisions, such as theft, vandalism, or natural disasters.

- Legal Compliance: Businesses that use vehicles for commercial purposes are often required by law to carry commercial auto insurance. Having the right policy in place ensures compliance with state regulations and protects the business from potential legal consequences.

- Additional Customization: Commercial auto policies can be tailored to meet specific business needs, allowing companies to add coverage options such as roadside assistance, rental reimbursement, or coverage for hired vehicles.

Coverage Variations

When comparing a commercial auto policy with personal auto insurance, it's important to note the differences in coverage limits and exclusions.

Coverage Limits

Commercial auto policies typically offer higher coverage limits compared to personal auto insurance. This is because commercial vehicles often carry more risk due to frequent use and transportation of goods or passengers.

- For example, a commercial auto policy may provide coverage of up to $1 million for liability claims, while personal auto insurance typically has lower limits.

- Commercial policies also offer higher limits for property damage and medical expenses, reflecting the increased exposure to risk in commercial operations.

Extensive Coverage Scenarios

Commercial auto policies are designed to provide coverage for a wide range of scenarios that are not typically covered by personal auto insurance.

- For instance, commercial policies may include coverage for employees driving company vehicles, transporting goods or equipment, or making deliveries.

- In the event of an accident while using a vehicle for business purposes, a commercial auto policy would provide coverage for both the vehicle and any liability claims arising from the incident.

Exclusions

There are specific exclusions in commercial auto policies that are not present in personal auto insurance, reflecting the unique risks associated with commercial operations.

- Common exclusions in commercial policies include coverage for vehicles used for racing, vehicles with a gross weight exceeding a certain limit, or vehicles used for hire or reward.

- Additionally, some commercial policies may exclude coverage for certain types of cargo or specialized equipment used in commercial operations.

Premium Determinants

When it comes to commercial auto policies versus personal auto insurance, the calculation of premiums differs significantly. Insurance companies take into account various factors when determining premiums for commercial vehicles, considering the higher risk associated with business use.

Factors Considered for Premium Calculation

- The type of business and industry: Certain industries may pose a higher risk, impacting the premium rates.

- Driving history of employees: The driving records of employees who will be operating the commercial vehicles play a crucial role in premium calculation.

- Vehicle type and usage: The size, type, and purpose of the commercial vehicle are key factors in determining the premium.

- Mileage: The annual mileage driven by the commercial vehicles can influence the premium rates.

- Location of operations: The location where the commercial vehicles will be primarily operated affects the premium costs.

Discounts and Incentives

- Multi-policy discount: Insurance companies may offer discounts to businesses that bundle their commercial auto policy with other insurance products.

- Safety programs: Implementing safety programs and measures within the business can lead to lower premiums.

- Telematics devices: Some insurers offer discounts for businesses that use telematics devices to monitor driving behavior and improve safety.

- Claims-free discount: Businesses with a history of minimal or no claims may qualify for discounts on their premiums.

Legal Requirements

When it comes to commercial auto insurance versus personal auto insurance, there are specific legal requirements that businesses need to consider. State regulations play a significant role in determining the coverage needed for commercial vehicles, which can vary based on the type of business and the nature of the vehicles used.

State Regulations Impacting Coverage

In the United States, each state has its own set of regulations governing the minimum insurance requirements for commercial vehicles. These regulations may include mandatory liability coverage, uninsured motorist coverage, and in some cases, additional coverage based on the nature of the business operations.

It is essential for businesses to be aware of and comply with these state regulations to avoid legal consequences.

- State regulations may require businesses to carry higher liability limits for commercial vehicles compared to personal vehicles.

- Some states may mandate specific types of coverage, such as cargo insurance for businesses transporting goods.

- Businesses operating in multiple states must adhere to the insurance requirements of each state in which they operate.

Consequences of Inadequate Coverage

Not having adequate commercial auto insurance can have severe consequences for a business. In the event of an accident or damage involving a commercial vehicle, a business could face financial losses, legal liabilities, and even potential closure if they are unable to cover the costs.

Additionally, failing to comply with state regulations regarding commercial auto insurance can result in fines, penalties, and legal repercussions that can significantly impact the business's operations and reputation.

Last Point

In conclusion, the differences between Commercial Auto Policy and Personal Auto Insurance have been dissected, offering a comprehensive view of the benefits and considerations for each. Make informed decisions based on the insights shared in this guide to protect your vehicles effectively.

Answers to Common Questions

What vehicles are typically covered under a commercial auto policy?

Commercial auto policies usually cover vehicles used for business purposes, such as delivery trucks, company cars, and service vehicles.

How are premiums calculated differently for commercial auto policies compared to personal auto insurance?

Premiums for commercial auto policies are often based on factors like the type of business, vehicle usage, driving history of employees, and coverage limits needed.

What are some common exclusions in commercial auto policies that are not found in personal auto insurance?

Commercial auto policies may exclude coverage for certain types of cargo, goods in transit, or specific high-risk activities related to business operations.