Delving into A Complete Guide to Commercial Auto Policy for Small Businesses, this introduction immerses readers in a unique and compelling narrative, with a tone that is engaging and thought-provoking from the very first sentence.

Providing detailed information on the importance of commercial auto insurance for small businesses, the key differences from personal auto insurance, and the types of vehicles covered under such policies.

Understanding Commercial Auto Policy

Commercial auto insurance is crucial for small businesses that rely on vehicles for daily operations. It provides financial protection in case of accidents, theft, or damage to company vehicles.

Key Differences Between Commercial and Personal Auto Insurance

- Commercial auto insurance covers vehicles used for business purposes, such as delivery trucks or company cars, while personal auto insurance is for personal use vehicles.

- Commercial policies typically have higher liability limits to protect businesses from costly lawsuits.

- Commercial auto insurance may also cover employees driving company vehicles, unlike personal auto insurance.

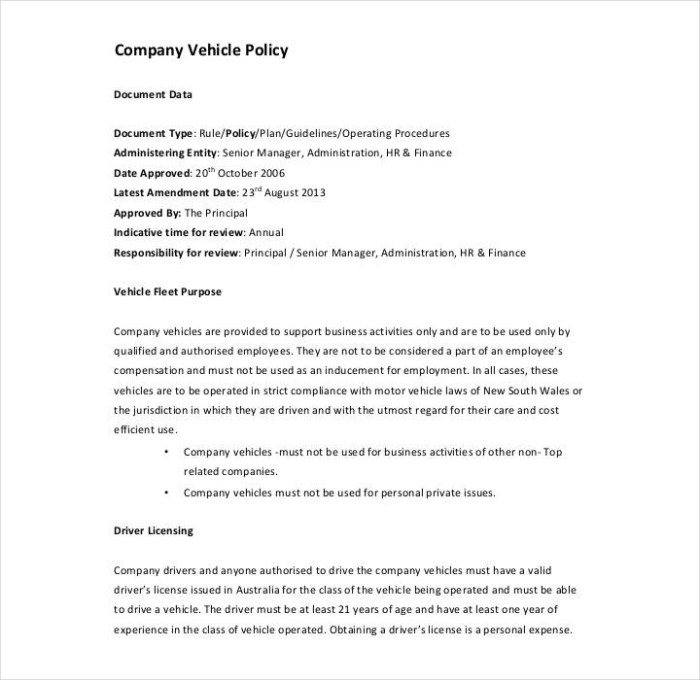

Types of Vehicles Covered Under Commercial Auto Policy

- Delivery vans and trucks

- Company cars used for business purposes

- Service vehicles like plumbing or electrical vans

- Box trucks and trailers used for transporting goods

Coverage Options

When it comes to commercial auto policies for small businesses, there are several coverage options to consider. Each type of coverage offers different benefits and protection for your vehicles and drivers.

Liability Coverage

Liability coverage is essential for any commercial auto policy as it protects your business from financial losses in case of an at-fault accident. This coverage helps pay for damages and injuries to the other party involved.

Collision Coverage

Collision coverage helps repair or replace your vehicle if it's damaged in a collision with another vehicle or object. This coverage can be crucial for small businesses that rely on their vehicles for daily operations.

Comprehensive Coverage

Comprehensive coverage protects your vehicles from non-collision related incidents such as theft, vandalism, or natural disasters. This coverage can provide peace of mind knowing your vehicles are protected in various scenarios.

Uninsured/Underinsured Motorist Coverage

This coverage steps in if you're involved in an accident with a driver who doesn't have insurance or enough insurance to cover the damages. It helps protect your business from having to pay out of pocket for repairs and medical expenses.

Determining Coverage Needs

Determining the appropriate coverage for your small business's commercial auto policy is crucial to protect your assets and ensure financial security in case of accidents or damages. By evaluating your operations, vehicles, and potential risks, you can tailor your coverage to meet your specific needs.

Assessing Coverage Needs

- Consider the types of vehicles used in your business operations, including trucks, vans, or cars, and their respective purposes.

- Evaluate the frequency and distance of travel for your vehicles, as higher mileage or long-distance trips may increase the risk of accidents.

- Assess the nature of your business activities and potential hazards, such as transporting hazardous materials or operating in high-risk areas.

Checklist for Coverage Limits

- Determine the minimum coverage required by state law for commercial auto insurance.

- Calculate the total value of your business assets, including vehicles, to establish adequate coverage limits.

- Assess the potential financial impact of accidents, injuries, or damages on your business to determine optimal coverage limits.

Factors Influencing Insurance Costs

- Driving records of employees operating commercial vehicles.

- Type and purpose of commercial vehicles used in business operations.

- Location and area of service, as urban areas may have higher insurance rates due to increased traffic and potential risks.

- Selected coverage options, deductibles, and limits that impact premium costs.

- Claims history and previous incidents that may affect insurance rates.

Policy Exclusions and Limitations

When it comes to commercial auto policies, small business owners need to be aware of the various exclusions and limitations that may affect their coverage. Understanding these can help them make informed decisions and ensure they have adequate protection for their vehicles and drivers.

Common Exclusions in Commercial Auto Policies

- Intentional acts: Damage caused intentionally by the insured party is typically not covered.

- Racing or speed contests: Accidents that occur during racing or speed contests are usually excluded.

- Using vehicle for hire: If the vehicle is used for hire or as a taxi, coverage may be limited or excluded.

Limitations of Coverage and Additional Policies

- Non-owned vehicles: Coverage for vehicles not owned by the business may be limited under a standard policy.

- Personal use: If the vehicle is used for personal errands, coverage may be limited or excluded.

- Hired vehicles: Additional coverage may be needed for vehicles that are rented or leased for business purposes.

Examples of Claims Not Covered

- Damage caused by an employee driving under the influence of alcohol or drugs may not be covered.

- Accidents that occur outside the specified geographical area of coverage may not be eligible for a claim.

- Acts of vandalism or theft without proper documentation or evidence may not be covered.

Closure

Concluding our discussion on A Complete Guide to Commercial Auto Policy for Small Businesses, we have explored the ins and outs of coverage options, determining coverage needs, policy exclusions, and limitations in an engaging manner.

Helpful Answers

What are the key differences between commercial auto insurance and personal auto insurance?

Commercial auto insurance is specifically designed to cover vehicles used for business purposes, while personal auto insurance is for personal use vehicles.

How can small businesses determine their coverage needs?

Small businesses can assess their coverage needs based on the type of operations they have and the vehicles they use.

What are common exclusions in commercial auto policies?

Common exclusions include using vehicles for illegal activities or racing, among others.

![10 Best Magento Ecommerce Agencies [+ Tools] L Klizer](https://ecommerce.goodstats.id/wp-content/uploads/2025/09/5-24-1-350x250.png)