Top Payment Gateways for Ecommerce in Asia: A Comprehensive Guide

Exploring the realm of payment gateways in the bustling e-commerce landscape of Asia, this introduction sets the stage for an insightful journey filled with valuable information and key insights.

As we delve deeper, we will uncover the intricate web of payment gateways that underpin the thriving e-commerce industry in Asia, shedding light on crucial aspects that businesses need to consider for seamless transactions.

Overview of Payment Gateways in Asia

Payment gateways play a crucial role in the e-commerce ecosystem by facilitating secure online transactions between buyers and sellers. They act as a bridge between the customer's payment method and the merchant's bank account, ensuring smooth and seamless payment processing.

Importance of Payment Gateways in E-commerce

Payment gateways are essential for businesses operating in the digital space, as they provide a secure and convenient way for customers to make purchases online. They help in reducing the risk of fraud, ensuring data security, and improving the overall shopping experience for consumers.

- Secure Transactions: Payment gateways use encryption technology to protect sensitive financial information, making online transactions safe and secure.

- Global Reach: With the ability to accept multiple currencies and payment methods, payment gateways enable businesses to reach customers worldwide.

- Convenience: By offering various payment options like credit/debit cards, e-wallets, and bank transfers, payment gateways cater to the diverse needs of customers, enhancing the shopping experience.

Key Factors Making Payment Gateways Crucial for Businesses in Asia

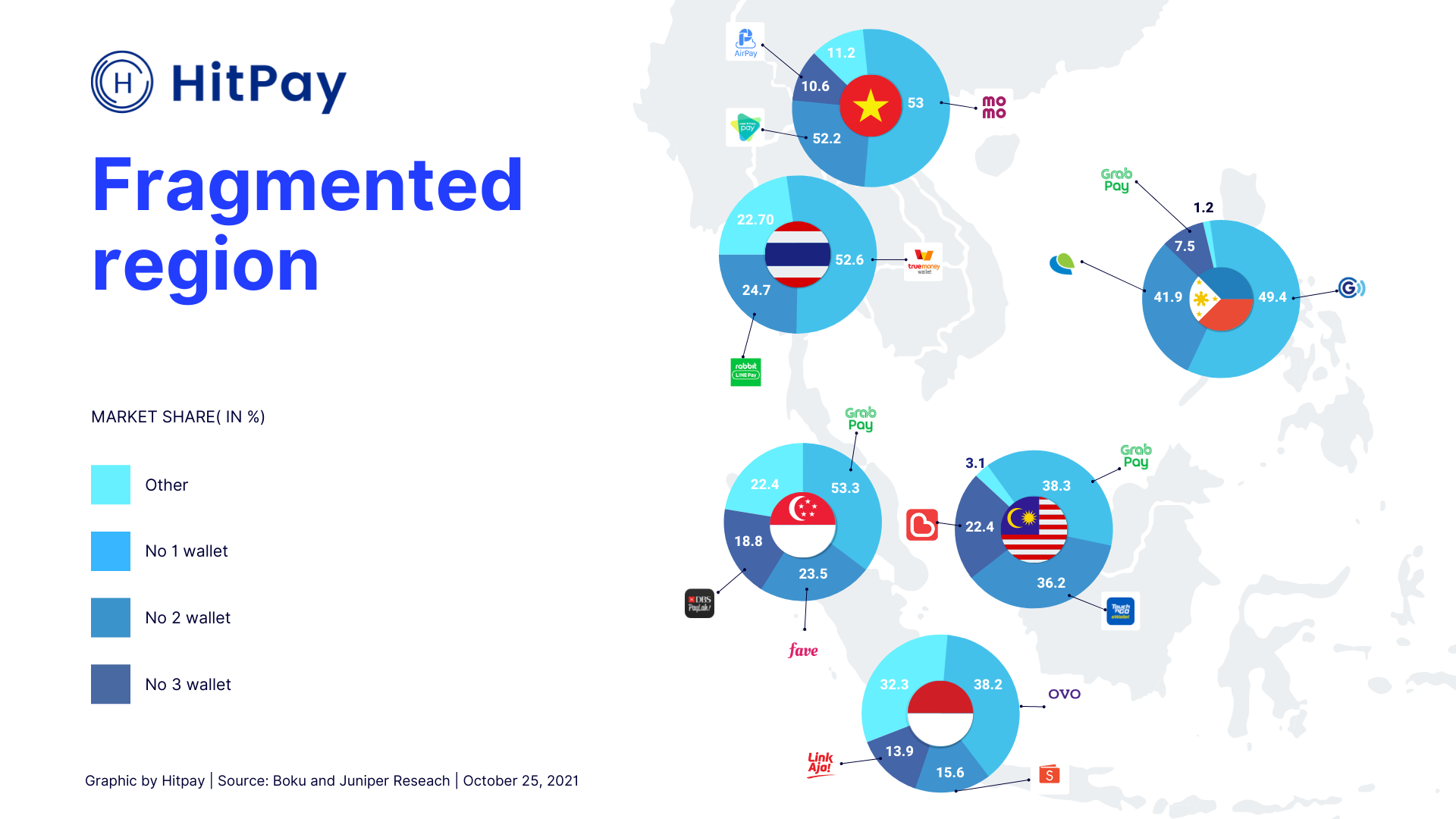

Asia is a diverse market with a booming e-commerce sector, making payment gateways indispensable for businesses looking to tap into this growing consumer base. Some key factors that highlight the importance of payment gateways in Asia include:

- Rapidly Growing E-commerce Market: Asia has witnessed a significant increase in online shopping activities, driving the demand for secure and efficient payment processing solutions.

- Mobile Commerce Trend: With the rise of smartphone penetration in Asia, mobile commerce has become increasingly popular, necessitating the need for mobile-friendly payment gateways.

- Cultural Preferences: Different countries in Asia have unique payment preferences, such as e-wallets in China and mobile banking in India, making it essential for businesses to offer a wide range of payment options through payment gateways.

Popular Payment Gateways Operating in the Asian Market

Asia boasts a diverse range of payment gateway providers catering to the specific needs of businesses and consumers in the region. Some popular payment gateways operating in Asia include:

- Alipay (China): A leading third-party online payment platform in China, offering secure and convenient payment solutions.

- PayPal (Global): Widely used across Asia and globally, PayPal provides a trusted and reliable payment gateway for online transactions.

- GrabPay (Southeast Asia): Popular in Southeast Asia, GrabPay offers a seamless mobile payment experience for users in the region.

Top Features to Look for in Payment Gateways

When selecting a payment gateway for your e-commerce business in Asia, it's crucial to consider a range of important features to ensure smooth transactions and secure payments. Here are some key features to look out for:

Security Measures

One of the most critical aspects to consider when choosing a payment gateway is the level of security it provides. Look for features such as:

- Encryption of sensitive data

- PCI DSS compliance

- Two-factor authentication

Integration with E-commerce Platforms

Seamless integration with your e-commerce platform is essential for a hassle-free payment process. Make sure the payment gateway you choose offers:

- Compatibility with popular e-commerce platforms like Shopify, Magento, or WooCommerce

- Easy installation and setup

- Customizable checkout options

Responsive Customer Support

Having reliable customer support can make a significant difference in resolving any payment-related issues quickly. Look for a payment gateway that offers:

- 24/7 customer support

- Multilingual support for customers in different regions

- Support via multiple channels such as phone, email, and live chat

Comparison of Top Payment Gateways in Asia

When it comes to choosing a payment gateway for your ecommerce business in Asia, it's crucial to consider various factors such as transaction fees, user experience, interface design, multi-currency support, and international payment options. Let's take a closer look at how some of the leading payment gateways in Asia compare in these aspects.

Transaction Fees

- Payment Gateway A: Transaction fee of X% for local transactions and Y% for international transactions.

- Payment Gateway B: Flat transaction fee of Z% for all transactions.

- Payment Gateway C: Tiered transaction fees based on transaction volume, starting from W%.

User Experience and Interface Design

- Payment Gateway A: Intuitive interface with easy navigation and quick checkout process.

- Payment Gateway B: Modern design with customizable features for seamless integration with ecommerce platforms.

- Payment Gateway C: User-friendly interface with detailed transaction history and reporting tools for merchants.

Multi-Currency Support and International Payment Options

- Payment Gateway A: Supports multiple currencies and offers international payment options for seamless transactions across borders.

- Payment Gateway B: Limited multi-currency support with additional fees for international transactions.

- Payment Gateway C: Extensive international payment options with competitive exchange rates for cross-border payments.

Case Studies

In this section, we will explore case studies of businesses in Asia that have successfully integrated payment gateways into their e-commerce operations. We will analyze the impact on sales, customer satisfaction, and any challenges faced during the implementation process.

Case Study 1: Company A

Company A, a popular online retailer in Southeast Asia, decided to implement a leading payment gateway to streamline their checkout process. By offering a variety of payment options and secure transactions, they saw a significant increase in sales within the first month of implementation.

Customer satisfaction also improved as the payment process became more convenient and reliable.

Case Study 2: Company B

Company B, a startup in India, initially faced challenges integrating a payment gateway due to technical issues and compatibility issues with their e-commerce platform. However, with the help of technical support from the payment gateway provider and dedicated IT resources, they were able to overcome these hurdles.

Once the payment gateway was successfully integrated, Company B saw a boost in sales and an increase in repeat customers due to the seamless payment experience.

Final Summary

In conclusion, the diverse landscape of payment gateways in Asia offers a myriad of opportunities for businesses to thrive and expand their reach. By understanding the key factors and features discussed, businesses can navigate the complex world of e-commerce with confidence and success.

Helpful Answers

What security measures should businesses prioritize when selecting a payment gateway in Asia?

Businesses should prioritize payment gateways that offer encryption, tokenization, and fraud detection features to ensure secure transactions.

Do payment gateways in Asia support multiple currencies for international transactions?

Yes, many payment gateways in Asia provide multi-currency support to facilitate international transactions and cater to a global customer base.

How do businesses overcome challenges during the implementation of payment gateways in Asia?

Businesses can overcome challenges by conducting thorough testing, providing adequate training to staff, and seeking support from the payment gateway provider for technical issues.